Divvy Homes is a rent-to-own program that allows you to lease a home while also giving you the chance to purchase the property at a later date. A percentage of the money you pay in rent goes towards the eventual purchase. It is not a loan and is helpful if you don’t qualify to purchase a home with a traditional mortgage.

Who is Divvy Homes Good For?

Divvy Homes gives you an alternative option if you can’t currently qualify for a traditional home loan. It might be a good option if you:

- Have a low credit score, insufficient credit history, or can’t make a large down payment.

- Want to build equity, unlike traditional renting. A portion of your rent goes towards building equity in the property, which you can apply to the future purchase.

- Have a non-traditional income, like freelance or contract work, or you haven’t been at your job long..

- Aren’t ready to commit to a long-term mortgage. Divvy Homes requires a 3-year lease, instead of a 15- to 30-year commitment like many mortgage programs.

- Want a stronger chance to get the home you want to purchase because Divvy makes an all-cash offer.

Currently, Divvy Homes only services 19 metro areas in Arizona, Colorado, Florida, Georgia, Minnesota, Missouri, Ohio, Tennessee, Texas. The company is expanding, and will put you on a waitlist if your area becomes eligible.

Who is Eligible

Divvy Homes is not a lender, and doesn’t provide mortgages. While you likely won’t have to meet the same credit score, income, and down payment requirements as a traditional home loan, there are still certain qualifications for entering into a contract with Divvy Homes:

- A minimum monthly household income of $2,500.

- The company prefers a good credit history with a minimum credit score of 550.

- You should have a stable job and income to ensure you can make the monthly rental payments. The company asks for at least 3-months proof of income.

- A commitment to leasing the home for a set amount of time, and eventually buying the property according to the contract. There is a cancellation fee if you decide not to go through with the purchase.

It’s important to note that the requirements may vary depending on where you live. If you are interested, Divvy Homes can direct you to their specific criteria for your situation.

How Does it Work?

Divvy homes has a transparent process that is outlined on their website including participant eligibility requirements, what homes it will purchase, and the terms of the contract. The steps include:

1. Apply online

The company has a pre-qualification process available on its website with a 5-minute application. The pre-approval is a soft credit check and doesn’t affect your credit score. If you decide to move forward, the company runs a complete background check and collects documents like your government issued ID and income verification.

You should find out within 24-48 hours if the company approves your application. The approval includes the monthly payment you qualify for and home shopping budget.

2. Find your home

You will work with a Divvy Homes advisor or your own agent to select a home that meets your needs and budget. The timeline for this process varies depending on your local market and the home available for sale. You can review the proposed offer price, lease terms, and other details before they make an offer to buy the property.

There is a $500 non-refundable deposit due that you can apply to your final home purchase. If the seller accepts the offer, Divvy re-reviews your application to make sure you are still eligible for the program.

The home needs to be a good investment for Divvy Homes and for you, and there are extensive requirements for homes it will purchase, including:

- Homes under $350,000 with at least 2 above-ground bedrooms.

- Been on the market for 30+ days.

- Must be a single-family detached home or fee-simple townhome that isn’t under condominium ownership.

- Sits on no more than 2-acres of land.

- Doesn’t back up to a major highway.

- Can’t use oil tanks or propane.

- No financed solar panels.

- Paved access road and driveway.

- In good condition with no signs of mold, structural issues, and unfinished repair work.

- No distressed properties like foreclosures, government owned, commercial or mixed-use, duplexes, or manufactured or modular homes.

- In most areas, central air-conditioning is required.

The list is long, but the Divvy agents are well-trained in the requirements and can work with you to find an eligible property. The company offers a comprehensive list of property eligibility requirements on its website.

3. Divvy buys the home

If the seller accepts the offer, Divvy Homes officially purchases the home. Before the closing, you are required to make a Divvy Savings Contribution of 1% to 2% of the purchase price and the first month’s rent payment.

4. Pay monthly rent and build equity

You are responsible for the monthly payment that includes the base rent and the percentage that goes towards your savings to buy the property, usually 10% to 25% of the total rent, or .10 to .25 of the home’s value. For example, if the home is worth $300,000, the company saves about $300 to $750 of your payment towards your purchase.

As you make monthly payments, the home gains equity. Your contributions can increase equity by about 10% each year.

The base rent is a fixed-amount, but the percentage you put towards savings is flexible and you can adjust it as-needed.

5. Purchase the home or cancel the contract

When you are ready, or at the end of the 3-year contract, you can purchase the home. Divvy Homes uses the accumulated equity from your monthly payments as a down payment.

If you decide not to purchase the property, you can move out and keep your accumulated savings, minus a cancellation fee of 1% to 2% of the initial purchase price.

The Basics

| Required credit score | 550 |

| Minimum monthly income | $2,500 |

| Documentation | Identification, pay stubs (at leasts 3-months) |

| Credit check | Yes |

| Background check | Yes |

| Lease term | 3-years |

| Upfront costs | $500, 1% to 2% of purchase price, 1st month’s rent |

| Cancellation penalty | 1% to 2% of the purchase price |

*data was accurate as the date of publishing, according to Divvy Homes website. Terms may differ from those mentioned above, and you should confirm with the company.

Divvy Homes Pros and Cons

Divvy Homes’ rent-to-own program can offer several benefits, but it also has some drawbacks.

Here are some pros and cons of the program:

Pros:

- You get built-in savings towards a down payment each month when you pay rent.

- With a pre-determined purchase price, you know what to expect when you buy the property.

- You have the flexibility to move out at the end of the lease term and pay a small cancellation fee or purchase the home.

- While there is an upfront cost, it is usually much lower than the 20% that can be required for a traditional mortgage.

- Divvy Homes covers some major maintenance items that you handle when you own a home like the roof, electrical and plumbing systems. The repair must be pre-approved by the company.

- Offers credit counseling and educational resources to help prepare you for your eventual home purchase.

Cons:

- You might pay a higher rent than a traditional rental property to account for the money that goes towards the savings for your eventual down payment.

- The program is only currently in 19 metropolitan areas.

- Homes must meet stringent eligibility requirements to qualify for the Divvy Homes program.

- Since you aren’t the legal owner of the home, you can’t claim tax benefits associated with homeownership, like mortgage interest deductions.

- If you decide to cancel, there is a fee of 1% to 2% of the initial home price.

- While the upfront cash is significantly less than a traditional mortgage, there are initial costs.

Consumer Sentiment

Consumer reviews of Divvy Homes are mixed. Some renters had an excellent experience and credit the company with allowing their family to purchase a home when it might not otherwise be possible. Reviewers frequently mention the ease of the application process. Negative reviews focus on lack of communication, transparency, and fees.

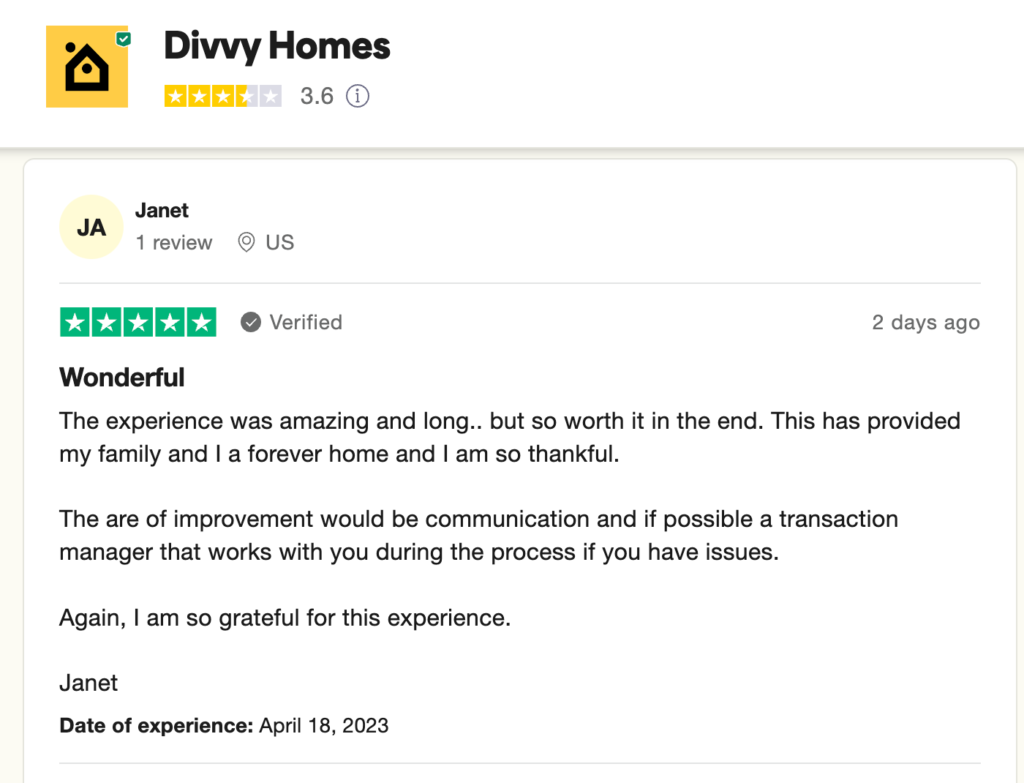

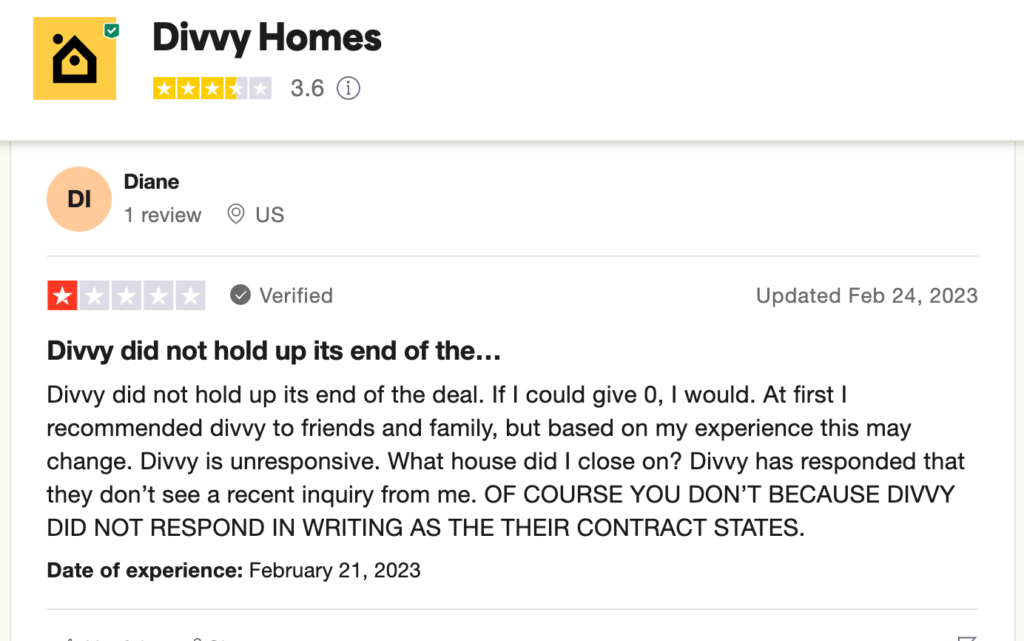

As of writing this article, the company has 2.23 out of 5 stars on the Better Business Bureau (BBB) website and 3.6 out of 5 starts on TrustPilot.

Positive reviews of Divvy Homes highlight:

5/5 stars on TrustPilot

The experience was amazing and long.. but so worth it in the end. This has provided my family and I a forever home and I am so thankful. The area of improvement would be communication and if possible a transaction manager that works with you during the process if you have issues. Again, I am so grateful for this experience. – Janet

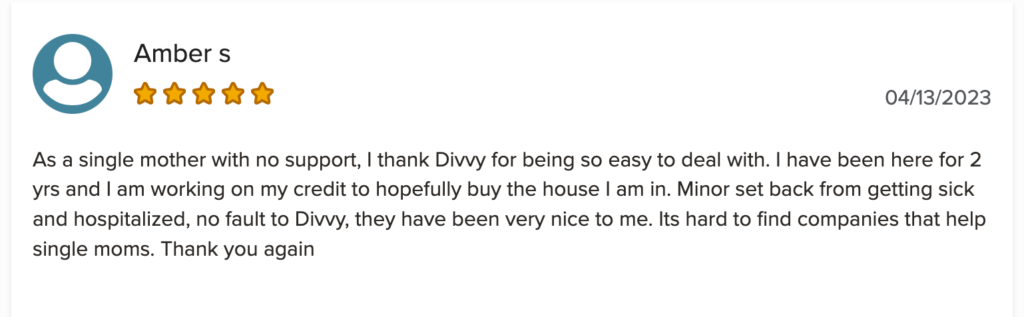

5/5 Stars on BBB

As a single mother with no support, I thank Divvy for being so easy to deal with. I have been here for 2 yrs and I am working on my credit to hopefully buy the house I am in. Minor set back from getting sick and hospitalized, no fault to Divvy, they have been very nice to me. It’s hard to find companies that help single moms. Thank you again – Amber S.

Negative reviews of Divvy Homes highlight:

1/ 5 Stars on BBB

Terrible experience with purchasing a home, every home we tried to get we were out bid on. Had to settle for a small cramped townhouse not worth the price. Was told that I could get my money back if I gave adequate notice to vacate which I did. I had over $6000 of saving after moving out but Divvy only agreed to return to me $684 which I still have not received. Horrible experience and it take forever to get a live person to call you back.- Onnie S.

1/ 5 Stars on TrustPilot

Divvy did not hold up its end of the deal. If I could give 0, I would. At first I recommended divvy to friends and family, but based on my experience this may change. Divvy is unresponsive. What house did I close on? Divvy has responded that they don’t see a recent inquiry from me. OF COURSE YOU DON’T BECAUSE DIVVY DID NOT RESPOND IN WRITING AS THE THEIR CONTRACT STATES. – Diane

Divvy Homes has mixed reviews, and it is always important to research any home rental or home ownership programs fully before committing.